Wash Sale: How it Work, Definition and Usage

A Wash Sale is a rule introduced by U.S. Internal Revenue Service (IRS) to stop tax payers from using tax deduction for capital losses on investment. This rule apply on taxable accounts and apply on both active traders and tax-losses.

1. The concept of Wash sale:

When you sell something like stock or mutual funds etc. at loss, you can deduct that loss to reduce your taxable income. If you purchase again the same thing with in a certain period of 30 days before or after the sale, the IRS considers this a wash sale.

2. Its Terms and Rules:

Substantially Identical Securities:

The term “Substantially Identical” is dangerous but not well-defined. The IRS interprets as, if selling Stock A and repurchase same stock within 61 days Window start the wash sale rule. If you sell preferred share of companies and buy same share it might initiate wash sale rule. It also initiate in mutual funds, selling one fund and buying another with a similarity also qualify.

The 61-Day Window:

The wash sale rule apply within 61-day window:

- 30 days before sale

- The day of sale

- 30 days after sale

Disallowed Loss:

When a wash sale occur, you can’t deduct the realized capital loss on tax return. The disallowed loss is add to the cost of the new security. The holding period of the new things also conveyed from old securities.

3. Examples:

1. Simple example:

Imagine, if you own 100 shares of stock A that purchased for $10 per share. The value of stock drops to $6 per share and you sell all for $600 that become a loss of $400. Now, within 30 days, you purchase same stocks at $7 that become total of $700.

Results:

The $400 is disallowed due to wash sale rule. This disallowed loss add in cost basis of repurchasing shares.

- New cost basis = $700+$400 that makes it $1,100

If you sell the same repurchased shares for $1,200 your gain would be $100 not $500.

2. Complex Example:

Now you sell 100 shares of Stock A at a $500 loss, within 30 days you buy call to repurchase Stock A in future.

Result:

The $500 loss is disallowed because of call option is considered substantially identical to the stock. The $500 loss is added to call option.

4. Special case:

- Retirement Accounts:

If you sell a stock in your taxable account at a loss and repurchase it in your IRA in 30 days the loss is disallowed. Basically, IRS doesn’t allow to add disallowed loss to IRA cost basis that means it is permanently lost.

- Tax loss Harvesting:

It is a strategy where investors sell securities at a loss to reduce taxes. While, wash sale rule limits to you that how quickly you can invest again in it.

- Corporate Action:

Corporates events like stock, splits, and spin off that can trigger wash sale. Example like selling shares of a company sell and receive share of new companies within 30 days can undergo to wash sale rule.

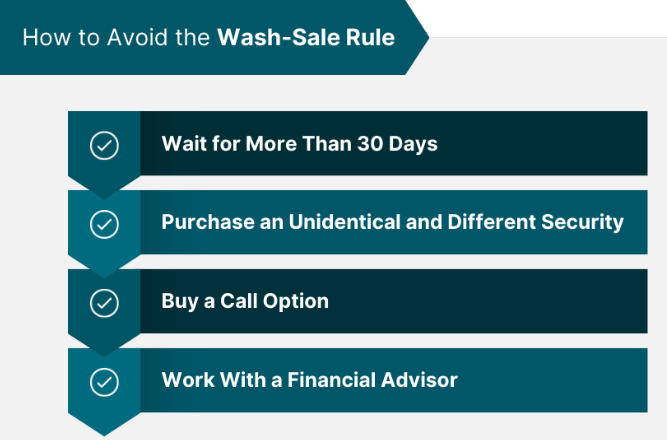

5. Avoid Wash sale:

If you want to avoid wash sale you have to do:

- Do not purchase same security until 31 days after sale.

- For example, if you sell U.S. stock ETF and buy a mid-cap ETF.

- Turn off divide investments in taxable accounts for 31 days.

6. Examples of Tax implications:

You sell stock at $5000 loss on 1st December and repurchase it on December 12, this initiate wash sale rule. You can’t cancel this loss on your taxes. The $5000 disallowed loss added to cost basis of repurchased shares.

The wash sale rule is reported on IRS Form 8949 which explain capital losses and gain.

7. Summary:

The wash sale rule stops investors from claim tax benefits for losses. This rule is beneficial for buyers but may cause some issues to investors. Buyers can enjoy time of 31 days because of this rule, Overall mujhe kuch smjh niayi iski to jisko ajaye mujhe bhi bata de.

One Comment